Step into the world of new savings accounts, where financial empowerment takes center stage. These innovative accounts offer a plethora of features and benefits, promising to transform your savings strategy and elevate your financial well-being. From competitive interest rates to flexible account options, new savings accounts empower you to make the most of your hard-earned money.

As we delve into the intricacies of new savings accounts, we will explore their advantages over traditional accounts, unravel eligibility requirements, and shed light on potential fees and charges. We will also provide invaluable guidance on selecting the perfect account for your unique financial needs, ensuring you make an informed decision that aligns with your long-term financial goals.

Features and Benefits of New Savings Accounts

New savings accounts offer a range of features and benefits that can help you save money and reach your financial goals. These accounts typically offer competitive interest rates, low fees, and flexible terms. Some new savings accounts also offer additional features, such as mobile banking, online bill pay, and access to financial planning tools.

There are many different types of new savings accounts available, each with its own unique advantages. Some of the most popular types of new savings accounts include:

- High-yield savings accountsoffer competitive interest rates, making them a great option for savers who want to earn the most interest on their money.

- Money market accountsoffer a combination of high interest rates and check-writing privileges, making them a good option for savers who need to access their money frequently.

- Certificates of deposit (CDs)offer fixed interest rates for a set period of time, making them a good option for savers who want to lock in a high interest rate for a longer period of time.

New savings accounts can be a great way to save money and reach your financial goals. However, it is important to compare the features and benefits of different accounts before choosing one. You should also consider your own individual needs and goals when choosing a new savings account.

Potential Risks and Limitations

As with any investment, there are some potential risks and limitations associated with new savings accounts. These include:

- Interest rates can change. Interest rates on new savings accounts can change at any time, which means that you could earn less interest than you expected. It is important to compare the interest rates on different accounts before choosing one, and to be aware of the potential for interest rates to change.

- Fees. Some new savings accounts have fees, such as monthly maintenance fees or transaction fees. It is important to compare the fees on different accounts before choosing one, and to make sure that you understand all of the fees that may apply.

- Limited access to funds. Some new savings accounts have restrictions on how often you can access your funds. For example, you may only be able to make a certain number of withdrawals per month. It is important to understand the terms of your account before choosing one, and to make sure that you have access to your funds when you need them.

It is important to weigh the potential risks and limitations of new savings accounts before choosing one. You should also consider your own individual needs and goals when choosing an account.

Comparison with Traditional Savings Accounts: New Savings Account

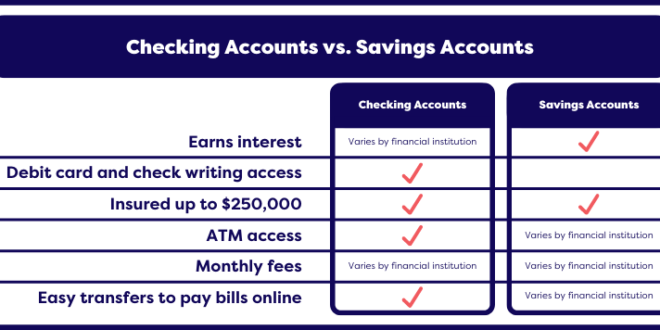

New savings accounts offer a range of features and benefits that differentiate them from traditional savings accounts. Understanding the key differences between these two types of accounts can help you make informed decisions about your savings strategy.

Traditional savings accounts typically offer a fixed interest rate, which means the amount of interest you earn on your savings will remain the same over time. New savings accounts, on the other hand, may offer variable interest rates, which can fluctuate based on market conditions.

Advantages of New Savings Accounts

- Higher interest rates: New savings accounts often offer higher interest rates than traditional savings accounts, which can lead to greater returns on your savings over time.

- Flexible interest rates: Variable interest rates can allow you to benefit from rising interest rates, potentially increasing your earnings.

- Additional features: New savings accounts may offer additional features such as mobile banking, online bill pay, and ATM access, providing greater convenience and flexibility.

Advantages of Traditional Savings Accounts

- Fixed interest rates: Traditional savings accounts offer fixed interest rates, which provide stability and predictability in terms of your earnings.

- Guaranteed returns: The fixed interest rate ensures that you will receive a specific amount of interest on your savings, regardless of market fluctuations.

- Simplicity: Traditional savings accounts are generally simple and straightforward to understand, making them a suitable option for those who prefer a basic savings vehicle.

Key Differences between New Savings Accounts and Traditional Savings Accounts

| Feature | New Savings Accounts | Traditional Savings Accounts |

|---|---|---|

| Interest rates | Variable, may fluctuate based on market conditions | Fixed, typically remain the same over time |

| Flexibility | May offer additional features such as mobile banking and online bill pay | Generally more limited in terms of features and flexibility |

| Earnings potential | Higher potential earnings due to higher interest rates and variable rates | Lower potential earnings due to fixed interest rates |

| Predictability | Less predictable earnings due to variable interest rates | More predictable earnings due to fixed interest rates |

Eligibility and Requirements

Opening a new savings account is a straightforward process with minimal eligibility requirements. To qualify, you must meet certain criteria and provide specific documentation.

Generally, you must be of legal age (18 years or older in most jurisdictions) and have a valid government-issued identification document, such as a passport or driver’s license. Some financial institutions may also require proof of address, such as a utility bill or bank statement.

Restrictions and Limitations

There may be certain restrictions or limitations associated with opening and maintaining a new savings account. These can vary depending on the financial institution and the type of account you choose.

- Minimum balance requirements:Many savings accounts have a minimum balance requirement that you must maintain to avoid monthly fees or other penalties.

- Transaction limits:Some savings accounts may limit the number of withdrawals or transfers you can make per month. This is to encourage saving rather than frequent access to funds.

- Age restrictions:Certain savings accounts may have age restrictions, such as accounts designed for children or seniors.

Steps to Open an Account

To open a new savings account, you can typically follow these steps:

- Choose a financial institution:Research and compare different banks or credit unions to find the best account for your needs.

- Gather required documentation:Make sure you have all the necessary documents, such as your ID, proof of address, and any other required information.

- Visit a branch or apply online:You can open an account in person at a bank branch or apply online through the financial institution’s website.

- Complete the application form:Fill out the application form accurately and provide all the requested information.

- Fund your account:Once your account is approved, you can fund it by transferring money from another account or depositing cash or checks.

Fees and Charges

Understanding the fees and charges associated with new savings accounts is crucial for making informed decisions. These fees can vary among different providers and can impact the overall value of the account.

Fee Structures

Each provider typically has its own fee structure for savings accounts. Common fees include monthly maintenance fees, transaction fees, overdraft fees, and ATM withdrawal fees. Monthly maintenance fees are charged regularly to keep the account active, while transaction fees apply to each withdrawal, deposit, or transfer.

Overdraft fees are incurred when you withdraw more money than you have available in your account, and ATM withdrawal fees are charged when you use an ATM that is not affiliated with your bank.

Tips for Choosing the Right New Savings Account

Selecting the ideal new savings account for your specific needs requires careful consideration. Interest rates, fees, account features, and customer service are crucial factors to evaluate. Here are some tips to guide your decision-making process:

Interest Rates

Higher interest rates on your savings account translate into greater returns on your deposits. Compare interest rates offered by different banks and credit unions to maximize your earnings. Consider both the current rate and potential future rate changes.

Fees and Charges

Be aware of any fees associated with your savings account, such as monthly maintenance fees, transaction fees, or overdraft fees. These charges can eat into your savings, so it’s essential to choose an account with minimal or no fees.

Account Features, New savings account

Consider the features offered by different savings accounts. Some accounts may provide additional perks, such as online banking, mobile check deposit, or ATM access. Choose an account that aligns with your banking habits and needs.

Customer Service

Excellent customer service is invaluable when managing your savings. Look for a bank or credit union with a reputation for responsive and helpful support. Consider factors such as availability, accessibility, and the ease of resolving any issues you may encounter.

Research and Comparison

Before making a decision, thoroughly research and compare different savings accounts. Utilize online comparison tools, consult financial advisors, or visit bank websites to gather information. By carefully evaluating your options, you can select the account that best suits your financial goals.

Conclusive Thoughts

In the realm of personal finance, new savings accounts emerge as a beacon of financial progress. They offer a comprehensive suite of features, catering to diverse financial aspirations. Whether you seek to grow your savings, establish an emergency fund, or simply optimize your financial management, new savings accounts provide a tailored solution.

Embrace the transformative power of these innovative accounts and unlock the gateway to financial freedom and prosperity.

Popular Questions

What are the key advantages of new savings accounts?

New savings accounts offer a range of benefits, including competitive interest rates, flexible account options, and convenient access to your funds. They are designed to help you grow your savings more efficiently and achieve your financial goals faster.

How do new savings accounts differ from traditional savings accounts?

New savings accounts offer several advantages over traditional savings accounts. They typically have higher interest rates, fewer restrictions on withdrawals, and more convenient features such as online and mobile banking.

What are the eligibility requirements for opening a new savings account?

Eligibility requirements for new savings accounts vary depending on the financial institution. Generally, you will need to be at least 18 years of age, have a valid government-issued ID, and provide proof of address.

Nenroll Nenroll News

Nenroll Nenroll News