In today’s digital age, depositing cash into your Capital One 360 account may seem like a relic of the past. However, with the convenience and accessibility of various deposit options, it remains a valuable tool for managing your finances. From the comfort of your home to the ease of local branches, this comprehensive guide will explore the ins and outs of deposit cash capital one 360, providing you with the knowledge and confidence to make informed decisions about your cash deposits.

Whether you’re a seasoned Capital One 360 user or new to the platform, understanding the deposit options available to you is crucial. This guide will delve into the various methods of depositing cash, their convenience, security measures, and troubleshooting tips.

By optimizing your cash deposits, you can maximize the benefits of your Capital One 360 account and achieve your financial goals.

Understanding Capital One 360 Deposit Options

Capital One 360 offers multiple convenient methods to deposit cash into your account, each with its own unique process, limits, and fees. Understanding these options will help you choose the best method for your specific needs.

Depositing Cash via ATM

Capital One 360 customers can deposit cash at any Capital One ATM without incurring a fee. Simply insert your debit card, select the “Deposit” option, and follow the on-screen prompts to complete the transaction. You can deposit up to $10,000 per day, with a maximum of $25,000 per month.

Depositing Cash at a Capital One Branch

If you prefer personal assistance, you can deposit cash at any Capital One branch. A teller will assist you with the transaction and verify your identity. There is no fee for depositing cash at a branch, and the daily and monthly limits are the same as for ATM deposits.

Depositing Cash via Green Dot Network

Capital One 360 has partnered with the Green Dot Network, allowing you to deposit cash at participating retail locations, such as Walmart and CVS. To use this service, you’ll need to find a Green Dot location, purchase a Green Dot MoneyPak, and then follow the instructions on the package to deposit the cash into your Capital One 360 account.

There is a fee of $4.95 per transaction, and the daily and monthly limits are lower than for ATM or branch deposits.

Convenience and Accessibility of Deposit Methods

Capital One 360 offers various deposit methods, each with its own level of convenience and accessibility. Understanding the differences can help you choose the best option for your specific needs.

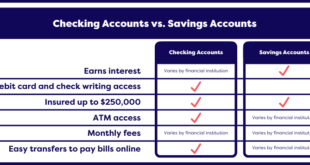

In-Branch Deposits

In-branch deposits allow you to deposit cash or checks directly at a Capital One 360 branch. This method is convenient if you have a branch nearby and prefer face-to-face interactions. However, branch availability and hours may vary, which could limit accessibility for some users.

Mobile Check Deposits

Mobile check deposits allow you to deposit checks remotely using the Capital One 360 mobile app. This method offers high convenience as you can deposit checks anytime, anywhere, as long as you have an internet connection. However, it’s important to note that check processing times may vary.

ATM Deposits

ATM deposits allow you to deposit cash or checks at any Capital One 360 ATM. This method provides 24/7 accessibility, making it convenient for those who need to deposit funds outside of branch hours. However, ATM availability may vary depending on your location, and there may be deposit limits or fees associated with this method.

Online Bill Pay

Online bill pay allows you to make payments to your Capital One 360 accounts directly from your external bank account. This method is convenient for setting up automatic payments or transferring funds from other accounts. However, it requires you to have an external bank account and may not be suitable for everyone.

Mail Deposits

Mail deposits allow you to send checks or money orders via mail to Capital One 360. This method is less convenient compared to other options as it involves physical mailing and may take longer for funds to be processed.

Security and Fraud Prevention Measures

Capital One 360 prioritizes the security of its customers’ deposits through a robust system of security measures and fraud prevention mechanisms.

To ensure the integrity of cash deposits, Capital One 360 employs:

Encryption and Secure Communication

- Advanced encryption protocols safeguard sensitive information, such as account numbers and deposit amounts, during transmission.

- Secure communication channels prevent unauthorized access to customer data.

Multi-Factor Authentication, Deposit cash capital one 360

Customers are required to undergo multi-factor authentication, typically involving a combination of password, PIN, and security code, to access their accounts and initiate cash deposits.

Fraud Monitoring and Detection

Capital One 360 employs sophisticated fraud monitoring systems that analyze deposit patterns, identify suspicious activities, and flag potential fraudulent transactions.

Customer Education and Awareness

Capital One 360 proactively educates its customers about common scams and fraudulent activities, empowering them to protect their accounts and avoid financial losses.

Avoiding Scams and Fraudulent Activities

- Be cautious of unsolicited requests for cash deposits or personal information.

- Only make deposits through official Capital One 360 channels.

- Review deposit confirmation messages carefully and report any discrepancies.

- Keep your account credentials confidential and avoid sharing them with others.

Optimizing Cash Deposits for Account Management

Maximize the benefits of Capital One 360 deposit services by strategically managing cash deposits. By aligning deposits with financial goals and employing effective tracking and management techniques, account holders can optimize their financial well-being.

Effective Deposit Strategies

- Set Financial Goals:Identify specific financial objectives, such as saving for a down payment or retirement, and tailor deposit amounts and frequency to achieve these goals.

- Regular Deposits:Establish a consistent deposit schedule, whether weekly, bi-weekly, or monthly, to build savings gradually and maintain account activity.

- Maximize Interest Earnings:Capital One 360 offers competitive interest rates. Consider maximizing earnings by making larger deposits or increasing deposit frequency to take advantage of compounding interest.

- Avoid Overdrafts:Track account balances closely and avoid making withdrawals that exceed available funds. Overdrafts can result in fees and impact credit scores.

Tracking and Management Techniques

Effective account management involves diligent tracking and management of deposits. Capital One 360 provides online and mobile banking tools that simplify this process.

- Online Banking:Access account information, view transaction history, and track deposits in real-time through the Capital One 360 online banking platform.

- Mobile App:The Capital One 360 mobile app allows for convenient deposit tracking, account management, and quick access to account information on the go.

- Transaction Notifications:Set up alerts to receive notifications via email or text message for deposits, withdrawals, and other account activity, ensuring timely tracking.

Tips for Maximizing Benefits

Capital One 360 offers various deposit services to meet different financial needs. Explore the following tips to maximize the benefits:

- Capital One 360 Performance Savings Account:This account offers competitive interest rates, making it ideal for maximizing interest earnings on cash deposits.

- Capital One 360 Checking Account:The 360 Checking Account provides easy access to funds, making it suitable for everyday banking and managing cash flow.

- Capital One 360 Money Market Account:The Money Market Account combines high interest rates with check-writing capabilities, offering a versatile option for managing larger cash deposits.

Troubleshooting and Support for Deposit Issues

Capital One 360 offers multiple channels to assist customers with deposit-related queries. This section provides troubleshooting steps for common deposit issues and guidance on contacting Capital One 360 for support.

Common Deposit Issues and Troubleshooting Steps

The following table Artikels common deposit issues and their respective troubleshooting steps:

| Deposit Issue | Troubleshooting Steps |

|---|---|

| Deposit not credited to account | – Verify the deposit amount and account number.

|

| Deposit rejected or reversed | – Check if the deposit method is supported.

|

| Deposit limit exceeded | – Check the daily and monthly deposit limits for your account.

|

| Deposit envelope lost or stolen | – Report the lost or stolen envelope to Capital One 360 immediately.

|

Contacting Capital One 360 for Support

Customers can contact Capital One 360 for support with deposit issues through the following channels:

- Phone:1-800-644-1010

- Secure Message:Log in to your Capital One 360 account and send a secure message.

- Live Chat:Available on the Capital One 360 website.

Resources and Documentation

Capital One 360 provides various resources and documentation to assist customers with deposit-related queries:

- Deposit FAQs:Visit the Capital One 360 website for frequently asked questions and answers about deposits.

- Deposit Agreement:Review the deposit agreement for terms and conditions related to deposits.

- Deposit Forms:Download deposit forms for check and cash deposits.

Final Conclusion

Depositing cash with Capital One 360 is a convenient and secure process that empowers you to manage your finances effectively. By understanding the different deposit options, optimizing your deposits, and utilizing the support resources available, you can ensure that your cash is deposited safely and efficiently.

Whether you’re a busy professional, a student, or simply someone who prefers the convenience of cash, Capital One 360 provides a range of deposit solutions to meet your needs. Embrace the ease and security of deposit cash capital one 360 and take control of your financial well-being.

FAQ Resource: Deposit Cash Capital One 360

Can I deposit cash at any Capital One branch?

Yes, you can deposit cash at any Capital One branch during regular business hours.

What are the limits for cash deposits?

The daily cash deposit limit varies depending on your account type and deposit method. Please refer to the Capital One website or contact customer support for specific limits.

How can I track my cash deposits?

You can track your cash deposits online through your Capital One 360 account or by contacting customer support.

Nenroll Nenroll News

Nenroll Nenroll News