Wells Fargo money order deposit offers a reliable and convenient way to deposit funds into your account. Whether you’re sending money to a friend or family member or making a payment, Wells Fargo’s money order deposit service provides a secure and efficient solution.

With Wells Fargo’s extensive network of branches and ATMs, depositing a money order is quick and easy. This guide will provide you with a comprehensive overview of Wells Fargo’s money order deposit process, including fees, limits, security measures, and benefits.

How Wells Fargo Money Order Deposits Work

Depositing a Wells Fargo money order is a convenient and secure way to add funds to your account. The process is simple and can be completed in a few minutes.

There are three main ways to deposit a Wells Fargo money order:

- In person at a Wells Fargo branch:This is the most common way to deposit a money order. Simply visit a Wells Fargo branch and present your money order to a teller. The teller will process your deposit and credit the funds to your account.

- By mail:You can also deposit a money order by mail. To do this, you will need to complete a deposit slip and include it with your money order. Mail the deposit slip and money order to the address provided on the slip.

- Through the Wells Fargo Mobile app:If you have the Wells Fargo Mobile app, you can deposit a money order using your smartphone. To do this, open the app and select the “Deposit” option. Then, follow the instructions on the screen to complete your deposit.

Fees and Limits Associated with Wells Fargo Money Order Deposits

When depositing a Wells Fargo money order, it’s essential to be aware of the associated fees and limits to avoid any unexpected charges or inconveniences.

There is no fee to deposit a Wells Fargo money order at a Wells Fargo branch or ATM. However, fees may apply for deposits made through other channels, such as mobile banking or third-party services.

Deposit Limits

Wells Fargo has established limits on the amount of money that can be deposited using a money order. These limits vary depending on the deposit method used:

- Branch Deposit:Up to $10,000 per day, with a maximum of $50,000 per month.

- ATM Deposit:Up to $3,000 per day, with a maximum of $10,000 per month.

- Mobile Banking Deposit:Up to $2,500 per day, with a maximum of $5,000 per month.

For deposits exceeding these limits, customers may need to visit a Wells Fargo branch or explore alternative deposit options.

Fees for Non-Wells Fargo Money Orders

If you’re depositing a non-Wells Fargo money order, an additional fee of $5 may apply. This fee is charged to cover the processing and verification costs associated with non-Wells Fargo money orders.

Security Measures for Wells Fargo Money Order Deposits

Wells Fargo takes several security measures to protect your money order deposits and prevent fraud. These measures include:

Secure Deposit Process:Wells Fargo’s online and mobile banking platforms use advanced encryption technology to protect your personal and financial information during the deposit process.

Identification and Avoidance of Fraudulent Money Orders

- Check the Watermark:Genuine Wells Fargo money orders have a unique watermark that is visible when held up to light.

- Examine the Security Features:Look for security features such as microprinting, color-shifting ink, and holograms.

- Verify the Issuing Bank:Contact Wells Fargo or visit their website to confirm that the money order is legitimate.

- Be Cautious of Unfamiliar Senders:Be wary of money orders received from unknown or untrustworthy sources.

Tips for Keeping Money Orders Safe

- Store Securely:Keep money orders in a safe place, such as a locked drawer or safe deposit box, until you are ready to deposit them.

- Avoid Carrying Large Amounts:If possible, avoid carrying large amounts of money orders in cash.

- Deposit Promptly:Deposit money orders as soon as possible to minimize the risk of loss or theft.

- Endorse Properly:Sign the back of the money order with your name and the date of deposit.

Benefits of Using Wells Fargo Money Order Deposits

Wells Fargo money order deposits offer a convenient and secure way to manage your finances. They provide several benefits over traditional cash or check deposits, including:

Enhanced Security

Money orders are more secure than cash or checks because they are backed by the issuing financial institution. If a money order is lost or stolen, it can be replaced, unlike cash or a personal check.

No Overdraft Fees, Wells fargo money order deposit

Unlike debit card transactions, money order deposits do not carry the risk of overdraft fees. This is because the funds are withdrawn from your account at the time of purchase, ensuring that you only spend what you have available.

Convenience

Money order deposits can be made at any Wells Fargo branch or ATM, making them accessible and convenient. You can also deposit money orders through the Wells Fargo Mobile app, allowing you to manage your finances on the go.

Wide Acceptance

Money orders are widely accepted as a form of payment, both in the United States and internationally. This makes them a versatile option for sending or receiving funds.

Competitive Fees

Wells Fargo offers competitive fees for money order deposits, making them an affordable option for managing your finances.

Alternatives to Wells Fargo Money Order Deposits

There are several alternatives to using Wells Fargo money orders for depositing money, each with its own fees, limits, and security measures. Choosing the best option depends on your specific needs and preferences.

Here are some common alternatives:

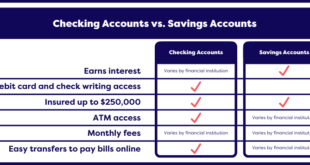

Cash Deposits

- Fees:Free at Wells Fargo branches, may incur fees at other banks or ATMs.

- Limits:Daily and monthly deposit limits may apply, depending on the bank.

- Security:Relatively secure, as cash is physically deposited into an account.

Checks

- Fees:May incur fees for depositing checks at non-Wells Fargo ATMs or branches.

- Limits:Daily and monthly deposit limits may apply, depending on the bank and the type of check.

- Security:Less secure than cash deposits, as checks can be forged or lost.

Electronic Transfers (ACH)

- Fees:May incur fees for transferring funds from non-Wells Fargo accounts.

- Limits:Daily and monthly transfer limits may apply, depending on the bank.

- Security:Relatively secure, as funds are transferred electronically through a secure network.

Mobile Deposits

- Fees:Free for Wells Fargo customers, may incur fees for non-Wells Fargo customers.

- Limits:Daily and monthly deposit limits may apply, depending on the bank.

- Security:Relatively secure, as funds are transferred electronically through a secure network and require the use of a mobile banking app.

Closure

In conclusion, Wells Fargo money order deposit is a versatile and secure option for managing your finances. Whether you’re depositing a small amount or a large sum, Wells Fargo provides a convenient and reliable service that meets your needs. With its low fees, competitive limits, and robust security measures, Wells Fargo money order deposit is the ideal choice for individuals and businesses alike.

Quick FAQs

What are the fees associated with depositing a Wells Fargo money order?

Wells Fargo does not charge any fees for depositing a money order purchased at a Wells Fargo branch. However, fees may apply for depositing money orders purchased from other financial institutions.

What is the maximum amount I can deposit using a Wells Fargo money order?

The maximum amount you can deposit using a Wells Fargo money order is $10,000 per day. This limit may vary depending on your account type and transaction history.

How can I identify and avoid fraudulent money orders?

To avoid fraudulent money orders, always inspect the money order carefully before accepting it. Look for any signs of tampering or alteration, such as misspellings or irregularities in the printing. Additionally, never accept a money order that has been signed or endorsed by the sender.

Nenroll Nenroll News

Nenroll Nenroll News